US Tax Law requires that US-based companies like Amazon KDP, Smashwords, iTunes and Createspace, must withhold 30% of any non-US self-publisher’s royalties.

Basically, if you are not an American and you just signed up for a KDP account, Amazon will automatically keep 30% of your earnings for tax reasons. This isn't to be confused with Amazon's cut of your earnings…this is on top of your earnings. So, if your book is priced at $9.99, Amazon keeps 30%, and also withholds another 30% for taxes, and you're left with…40%.

Ouch!

Losing and extra 30% of your hard earned money is a hard pill to swallow!

Thankfully, depending on where you live, you can take 5 easy steps to change it around and reduce that percentage and in some cases, completely remove it.

Which equals more money in your pocket.

In this article, you will learn about:

- What countries can reduce the Amazon tax withholdings

- Amazon’s tax withhold requirements

- What is an ITIN and an EIN and which one do we need

- 5 simple steps to get your own EIN and reduce your losses in all markets

- Using the steps above, how you can get an ACX account even if you're a non-US resident

Table of contents

My mini disclaimer- I am neither a lawyer nor a financial planner. For any specific tax questions and how to go about paying taxes on your royalties in your country and similar issues, you will need to consult it with someone like an international tax adviser, an accountant or a lawyer.

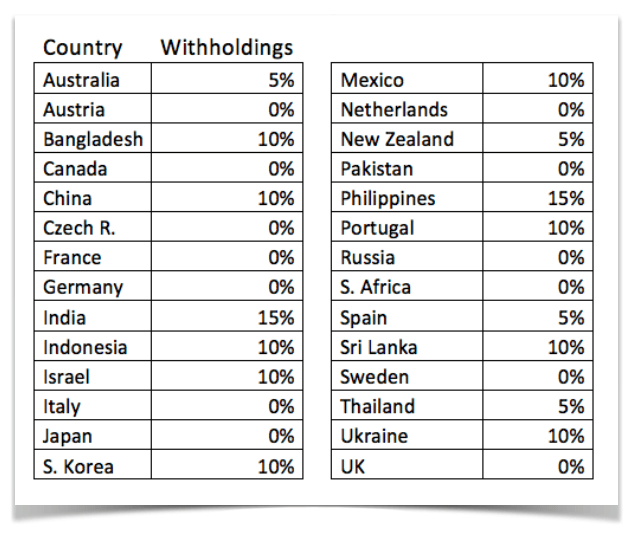

List of Country Tax Withholding Rate

Are you eligible to reduce your US tax withholdings? The answer is….it depends.

It depends on where you live, or where your company is registered, and what Tax Treaty that country (where your fiscal residence is) and the US have in place.

To make it easier for you, I have listed them here:

Remember, it depends on where you live OR where your business resides, not what nationality you are.

For example, when I lived in Sri Lanka, even though I am American, I would have had to pay the Sri Lankan 10%. However, I set up a publishing company in the US, and was, therefore, able to not pay any taxes, thus saving myself the 10% Sri Lankan tax withholding, which ultimately saved me over $20,000 during that time.

To access the full list of countries directly from the IRS click here. Also, for more information on how Amazon sees the tax withholdings, check out their official page here.

EIN versus ITIN

So, now that we know that you're eligible, we need to get a particular tax number. You can either get an Individual Tax Identification Number (ITIN) or you get an Employer Identification Number (EIN).

The quick and dirty between the two is that an ITIN takes a LONG time to get and requires lots of steps like filling out forms, paying fees, and visiting U.S. Embassies or consulates.

Luckily for us though, the American IRS views non-US authors as small business owners and therefore allows an EIN to be granted…which you can get from the comforts of your own home and even in your pajamas.

For more information on ITIN vs EIN, check this out.

Update – as for 2017, instead of calling the IRS, you could also try to use your local tax number (individual, or if you operate as a corporation- your corporate tax number). However, while this will work for most non-US countries, in some cases, you still may have to call IRS to get your EIN number. If that’s your case, then the following instructions will help you.

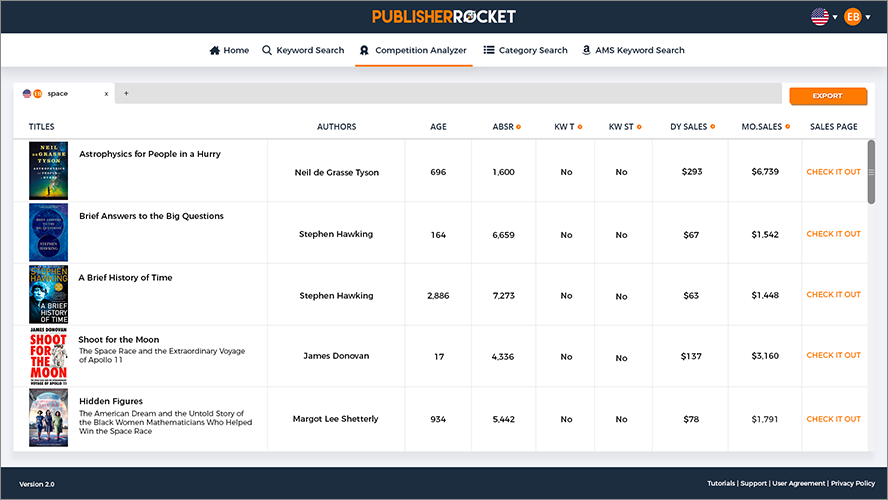

Best Book Marketing Software

Over 47,000+ authors, NYT bestsellers, and publishing companies use Publisher Rocket to gain key insight to the market. Help your book now

Get Rocket NowLet’s Get Rid of the Holding: How to Get an EIN

First things first- get your EIN number. You have nothing to lose but a lot to gain. For that, all you need to do is to call the IRS and simply ask them for your EIN number.

You used to be able to fill out an online form, however, in 2014 the form changed and now requires a Social Security Number (SSN) or an ITIN. You can get around this by calling.

TIP: Their office hours are 7 AM- 10 PM US Eastern Time. I suggest you call them early in the morning (their local time) or at the end of their shift.

They will ask you for your name, surname, and your address. In case you operate as a company, make sure you communicate that and explain what your company does.

They will ask you for a reason for your call. Again, these are the lines you want to use (you may want to jot them down on a piece of paper):

“I need an EIN number to comply with the IRS withholding regulations”

“I am not a US person, I am (your nationality) and I live in (your country of residence)”

“I am not starting an entity in the US”

“I am an individual and I need to fill my tax forms to obey with the US tax regulations. My intention is to (Insert reason like -publish eBooks on Amazon/work with American companies/ sell info products on Clickbank/ become an Amazon affiliate).”

“ I have recently started my self-publishing account with Amazon.com and I have to comply with the IRS withholding regulations and fill the W8 – Ben form”

After you provide this reasons, they will ask you some crazy questions like “Are you going to be operating heavy machinery in the US” and stuff like that. You know what to say, right?

Finally, they will give you your EIN number. Just write it down – you are ready to go. As soon as you get your EIN number, you can start using it. However, understand that it will take about one month before the IRS will update their information to reflect your EIN number. This will become important in the next step.

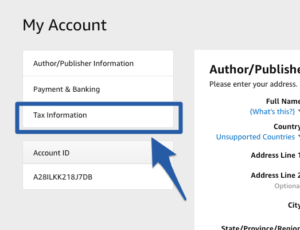

To Access Your KDP Tax information, do the following steps:

Step 1: Go to your account and click “(your name) Account”

Step 2: Then click on “Tax Information.”

Step 3: Then Click on “Complete Tax Information” or “View/Provide Tax Information” if you've already completed it.

When they ask “Do you have a U.S. TIN?” click yes and fill in your newly acquired EIN.

Then click submit and in about 10 days, you should be good to go. However, be prepared to get a rather depressing email from Amazon saying that your IRS records did not match (usually takes 1-2 weeks before getting this). Remember, it takes the IRS about a month in order to change your record.

To get through this, simply update your tax information and re-submit. After 2 more weeks, it should be fine, and your withholding rate will be reduced. Nothing to worry about. Easy peasy!

Foreign Tax Withholdings From CreateSpace, Smashwords, and other Book Markets

If you also publish paperbacks with Smashwords, Apple Books, Barnes & Noble, or just about any other US-based online book market, use the same EIN number to update your tax information. These other markets will not update it automatically.

I remember I skipped this step, as I believed that since Createspace is an Amazon company, it all updates itself automatically. Whoops!

But since it does not work that way, you need to make sure you update your tax information accordingly.

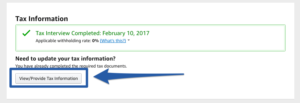

How to Get an ACX Account if You're Foreign

If you want to create an account with ACX.com (to publish audio books), all you need to get is a US address or that you can obtain from ReShip. Update: ACX now allows for Canadians as well.

You will also need a US bank account that you can get from Payoner.

Once you have gotten that address, just go ahead and start your account.

Use a different e-mail address (not the one you used for KDP or Createspace)

Fill in your tax information using your EIN number + putting all your residency details and your local address.

Note- The process of filling in your ACX, and even Amazon Associate tax information is exactly as in the case of KDP.

Need Help with Your Keywords?

Take my full featured video course on how to select the best keywords and categories for your book.

Take the CourseFinal tips:

Find someone like a tax strategist or an international lawyer locally, where you live. They will help you with your tax situation.

Important Note– don’t tell them that you “sell books” on Amazon. It’s Amazon that sells the books! Amazon sells and Amazon pays VAT and all other taxes like that. Tell them that you “receive royalties from Amazon”. Ask them to check your local regulations on royalties.

At some point, you may want to consider starting a company and publishing your books as a company. Especially if you want to scale and wish to deduct some expenses like covers, editors, marketing services from your tax.

In case you decide to upgrade your account to a company account, the process is very simple. You will need to get another EIN number for your company (call IRS following the same template, but give them your company details). Then, you will need to update the information on your KDP/ CS and ACX account. You could also use your local corporate tax number instead of your EIN number. As of 2017, it should work fine.

If you decide to change your company name, you will need to call IRS about it, and update the information on your Amazon accounts. I recommend you always contact KDP, CS and ACX support before making any changes. Just in case.

In many cases, it will be cheaper for you to do it as a company. To learn more about how you can start an LLC in the US, check out my article here.

Finally, remember that I am not a professional qualified in international taxes and stuff like that. I simply share some information based on my own research and experience. If you feel lost, consult with a good international lawyer or a tax strategist. But your EIN number is the step number one.

Good luck and may your bank account be happy with more royalties and less taxation! Happy and profitable publishing!

Hi Marta,

In your sharing, you mentioned that

“It depends on where you physically live (not where you are from) and what Tax Treaty that country and the US have in place.”

I like to know more about this, if I am a Taiwanese, and I am living/working in Thailand as a nomad, do you think I am able to apply from Thailand?

Please talk to an international accountant.

Also, we have updated the article now.

Many things depend on international laws,. tax treaties between different countries and your business entity. As an online business owner, you can register a company wherever you want, and then you pay corporate taxes there. But again- the only way to know what works for you is to talk to an accountant. You gotta pay something somewhere. But a good accountant will have a look at your assets and situation and design the best option for you.

Hi Marta,

I transitioned from a single person to a company in Singapore, is the EIN for a new company different from an individual? i haven’t called for any EIN before, but i did receive the 1042-S letters detailing that i’m staying in Malaysia and did complete the tax interview inside kdp. So as a company is it possible to get a new EIN from one of the listed reduced withholding countries?

when i call to ask for an EIN for my company, do i still answer like the above article, “I am not a US person, I am (your nationality) and I live in (your country of residence)”

hey Winson, we have updated the article now. I have a company in the UK, I went through an entire process and filled in with my company info, company tax number, back account etc. I think you could use both your local corporate tax number or the one from IRS (but it must be under your company name). But it may depend on your country, I have no idea how it works on Singapure.

When you call IRS as a company, they will ask about your company name, address, date of incorporation and activity. 🙂

This article pulled me down. I wasn’t aware that someone can ask for 30%. That is insane from affiliate marketer perspective. I can see that list above but many countries are missing. Where we can find complete list of countries? thanks

As far as I know, that’s it. All others are 30%.

Australia: 5%, Austria: 0%, Bangladesh: 10%, Barbados: 5%, Belgium: 0%, Bulgaria: 5%, Canada: 0%, China: 10%, Cyprus: 0%, Czech Republic: 0%, Denmark: 0%, Egypt: 15%, Estonia: 10%, Finland: 0%, France: 0%, Germany: 0%, Greece: 0%, Hungary: 0%, Iceland: 0%, India: 15%, Indonesia: 10%, Ireland: 0%, Israel: 10%, Italy: 0%, Jamaica: 10%, Japan: 0%, Kazakhstan: 10%, South Korea: 10%, Latvia: 10%, Lithuania: 10%, Luxemburg: 0%, Malta: 10%, Mexico: 10%, Morocco: 10%, Netherlands: 0%, New Zealand: 5%, Norway: 0%, Pakistan: 0%, Philippines: 15%, Poland: 10%, Portugal: 10%, Romania: 10%, Russia: 0%, Slovakia: 0%, Slovenia: 5%, South Africa: 0%, Spain: 5%, Sri Lanka: 10%, Sweden: 0%, Switzerland: 0%, Thailand: 5%, Trinidad & Tobago: 0%, Tunisia: 15%, Turkey: 10%, Ukraine: 10%, United Kingdom: 0%, Venezuela: 10%

You can always start a UK Ltd or a US LLC and do publishing as a company. I will be adding more info to this article soon and ask Dave to update it:)

Hi Marta, Really useful article, thanks. Do you have any information about how it works publishing through a UK limited company?

It’s simple, you set up a UK LTD and fill in your Amazon account with your company details. US- UK – 0%. You pay your taxes in the UK (on your profit of course). You pay yourself a salary or dividents (which is a company expense). Make sure you talk to an accountant if you want to incorporate etc. I am not qualified to guide you on how to set up a company (even though I am incorporated). Everyone has a different situation. It’s better to invest in an accountant and save yourself headaches.

Hi,

Thanks for this informative step by step post 🙂

Just wondering, is there a way to receive the already withheld royalties which were calculated at 30%?

Thanks!

Not sure

No, you can’t.

In case of KDP it may be even simpler. I filled my Tax Information interview, provided a foreign (so from my country) tax id number, my personal data and consent to submit all these info via digital means. It took me 5 minutes and I’m now eligible for 10% withholding.

I Poland the tax law is favorable for authors. It’s more benefitial to be an individual than a company.

yes, true my brother lived in Poland when he first got started on kindle (now he is a full time digital nomad and he changes countries pretty often) he said the same during the first year when he was only making 1-2 K a month. Some people worry too much about starting a company but they still don’t really have any business. However, when you reach 5K a month or more, and you also have more expenses (marketing, covers, editing) it makes more sense to do it as a company. Otherwise you will pay way too much taxes as an individual (at least here in Spain where I live, but Poland is the same, very few people in Poland make more than $5K a month or more) This will be my next guest blog post if Dave asks me, lol:) Besides, as a company you can write off lots of stuff from your tax so you don’t end up paying that much (UK is a great place to register a company). But if you are only to publishing part-time, you don’t make more than 5K a month, and don’t have any other businesses like we do, then it may be better for you to do it all as an individual. It’s always a good idea to talk to a few international tax attorneys (I love them all!). You can shoot us a message on facebook. We have a few awesome contacts (taxes are now my passion, lol).

It all depends on your income really. For me, it’s much more beneficial to operate as a company (I have a UK Ltd. which means 0% withholding in the US). All my friends from PL (or other European countries) who are successful online entrepreneurs also do their businesses (including publishing) as companies not individuals (as an entrepreneur you can choose where to register your company and UK is pretty good). But if you are just starting out, you can do it as an individual. Why not. it’s probably better for small royalty income. But if you are making serious money, sooner or later, you will need to consider registering a company. As an individual you will pay way too much personal income tax and you can’t write off costs that you can as a company (marketing, editors, VA’s and other freelancers, as a company I can even write off traveling, books, courses, seminars…+ the list goes on and on). It’s really important to get it right, most authors overlook it. I always advise people to talk to an accountant/tax attorney. Start as an individual but as soon as you start making money, upgrade to a company (then you will need to call IRS again and ask for a company EIN number). Again, UK Ltd is a fantastic option. Think as an entrepreneur.