You can start your own publishing company with these simple steps:

- Develop a business structure (usually an LLC)

- Choose the name and location for your company

- Register your business

- Obtain your EIN and set up a business banking account

Want more detail? Keep reading. This article is detailed, informative, and easy to comprehend — even for someone who was as legally inept as I used to be.

- If you should set up a publishing company

- The benefits of setting up a publishing company

- How to set up a publishing company

Table of contents

- What does a publishing company do?

- Should you start a publishing company?

- Benefits of Starting Your Own Publishing Company

- When should you start a publishing company?

- 6 Steps for Starting a Book Publishing Company

- Setting up a Publishing Company with MyCompanyWorks

- Resources For Setting Up a Publishing Company

What does a publishing company do?

A publishing company sells and distributes books (and magazines, newspapers, digital content, etc.) They may contribute to the editing process to ensure their published content is up to snuff. The publishing company decides what kind of marketing (and where to advertise) will best help sell their books.

Starting your own book publishing company is a crucial step in boosting your author brand, selling other people's books, or protecting yourself and your assets.

For many people, establishing your own company can be confusing, tedious, and downright painful. To be honest, it’s a lot of work.

Thankfully, this step-by-step guide will help you determine if you should start a publishing company and show you how to achieve such a daunting task.

Let me make 2 disclaimers:

- Although I have a lot of experience setting up LLCs, including my own book publishing company, I am by no means a lawyer or CPA and cannot speak on their behalf. If you have any questions, it is best to seek legal advice before moving on. This article does not constitute legal advice and should not substitute for the advice of an attorney.

- Some of the paperwork and legal steps listed in this article are pertinent to the US only. Each country will have its own laws for setting up such things. Many of the steps and recommendations below will be relevant to your startup, no matter which country you’re in.

Should you start a publishing company?

There are 3 primary reasons to start a publishing company:

- Financial protection

- Taxes

- Legitimacy

Of course, there are many reasons to start a publishing company, but these are the big three. For example, if you want to publish other people’s books, you can do that without an LLC. But if you do establish an LLC, you are protected and legitimate.

With today’s publishing platforms, you don’t have to start a publishing business to publish your own work or even other people’s stories.

However, starting a publishing company has several advantages. Here’s a more detailed list of reasons you may want to establish your own publishing business:

- Conveys professionalism and expertise

- Protects yourself, your work, and your personal assets in case of a lawsuit

- Manages of your intellectual property

- Allows for certain tax write-offs

- Maintains control over your work

- Gives you access to more than one Amazon KDP account

- Shifts your mindset from a hobby writer to a business owner

- Fulfills your dream of being The Boss/CEO/Founder of your own publishing company

- Establishes a legal entity to contract co-writing and licensing properly

- Facilitates future opportunities to publish books by other authors

How do publishing companies make money? Publishing companies make money by taking in book sales, minus the royalties they pay out to authors and other artists. Royalties are 100% negotiable.

Benefits of Starting Your Own Publishing Company

There are 6 excellent benefits to starting your own publishing company:

- Tax benefits, write-offs, and more

- Liability protection

- Increased credibility

- Ability to expand your brand

- Double the number of KDP accounts

- Co-writing and licensing

Of course, I could go on and on about the benefits — like being your own boss. But I’ll just take you through the main benefits, then along to the step-by-step process.

1. Tax Benefits, Write-Offs, & Wealth Building

Yes, there are tax benefits to having your own book publishing company. When April 15th approaches, you can write off a surprising number of business expenses.

A company helps you differentiate between your personal income and business income. All those business write-offs may save you a lot of money during tax season.

If you have your own company, I recommend getting a tax accountant (the fee for whom is a tax-deductible expense) to help prepare your taxes. During the year, an accountant can help you make the best choice in certain situations to take full advantage of the tax code.

The most common tax-deductible business expenses:

- Salaries, wages, and contract labor

- Most insurance policies

- Vehicle expenses

- Travel

- Office internet

- Supplies and office expenses

- Business meals

- Advertising and marketing

- Accounting fees

- Interest on the business-related debt

- Conferences

- Rented office space

- Home office

- Utilities

- Property purchased for business use

- Depreciation on that property

Saving money on taxes isn’t just about short-term gain. The benefits of establishing a publishing company allow you to see this business as an opportunity to build wealth and plan for retirement.

2. Liability Protection

Starting your own publishing company gives you a certain level of liability protection. If someone sues you for writing-related reasons and you have an LLC, they cannot attack your personal assets — only the company’s assets. There are some cases of copyright infringement though, where the author would be held liable for their actions, but in total there is much more protection for such things.

If you don’t have a company and your book, product, or service gets sued, then your personal finances and a public record will be absolute fair game.

Although it’s rare, lawsuits happen.

Vocabulary time: LLC stands for Limited Liability Company.

Ask me about my own experience getting sued. It was a false claim from a competitor looking to knock my book off the shelf. The world is full of jerks who are willing to lie and cheat the system (shocking, I know).

Starting a company gives you legal liability protection and distinguishes between the business’s finances and your personal finances. The courts, or collection agencies, would not be allowed to come after you — only your company’s assets.

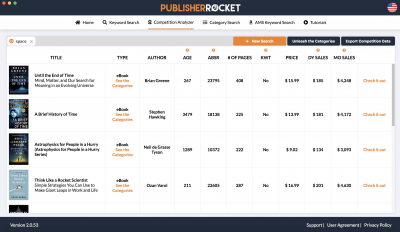

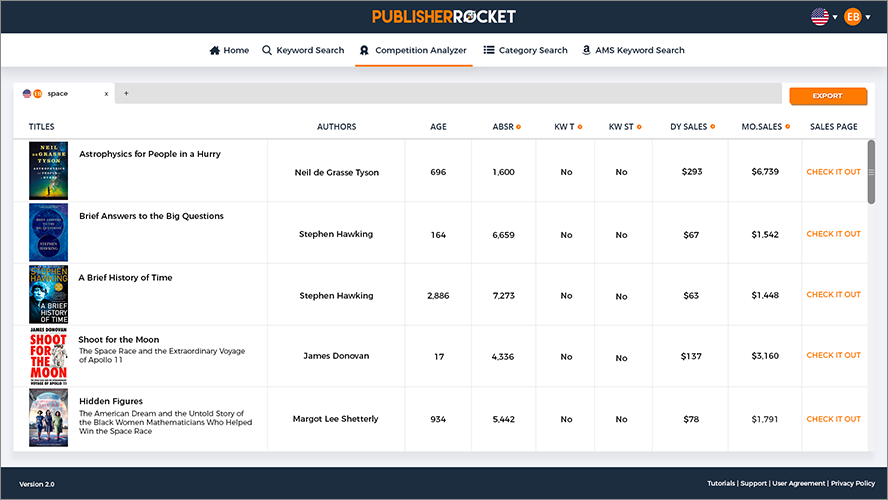

Book Marketing Made Simple

Over 47,000+ authors, NYT bestsellers, and publishing companies use Publisher Rocket to gain key insight to the market. Help your book now

3. Increased Credibility

When you start your own publishing company, it gives you increased credibility. Even though self-published authors are legitimate, having your own LLC sounds more legit and offers you and collaborators more legal protection.

Sharing that you’re a self-published author can be intimidating — you might have a fear that others will hear that you self publish and assume you couldn’t get published by a “real agency.”

But sharing that you have your own publishing company, through which you publish your books, gives you a sense of legitimacy.

Credibility isn’t just important for your sense of accomplishment, though. Collaborators, authors, and business partners may also be more likely to work with an established publishing company.

4. Ability to Expand Your Brand

Starting your own publishing business improves your ability to expand your author brand.

Author branding is convincing someone to read your book over anyone else’s. This involves establishing credibility, proving your creativity, and maintaining a professional image that doesn’t distract from those books you worked so hard on.

This process is related to book positioning: convincing someone that your book is right for them. Good author branding makes book positioning easier and vice-versa.

Also, having a publishing company can make it easier to collaborate with other authors. Each author has access to each other’s audiences, expanding both author brands.

Having a publishing company not only adds legitimacy to your career but also allows you to maintain control over your book marketing and lets you expand your author brand in so many other little ways.

5. Double the Number of KDP Accounts

Another added benefit to starting a publishing company is that you’ll be able to create another Amazon KDP account and remain within your rights.

Amazon's Terms Of Service (TOS) state that an author can only have one KDP account.

However, the cool part of owning your own publishing company is that your company would have its own EIN and bank account, which allows it to open its own KDP account within the TOS of Amazon.

So the first account is your personal account, and the second one is the company’s publishing account. Two accounts come with the added benefit of increased author pages through Author Central, and therefore more exposure and the use of more pen names.

6. Co-writing & Licensing

Starting your own publishing company lets you co-write with another person or license another individual’s work while maintaining legal protection, liability protection, and legitimacy.

Going through a publishing company is the preferred method of contracting with others to bind with legitimate operating agreements legally. So it’s good to have your own company.

Having a publishing business becomes your platform for licensing and contracting future opportunities, such as co-writing or publishing someone else’s work.

Keep this in mind for later when we discuss naming your company.

When should you start a publishing company?

You should start a publishing company if you have over $2,000 in book sales, want to protect your personal assets, want to publish other people’s books, and/or want to take full advantage of the US tax code.

I'll be real with you — not everyone should do this.

If you're just starting off or still see writing as a side gig or a hobby, then don't add the extra steps of starting a company to your already-busy schedule. Instead, focus on writing your book and nailing your marketing.

If you meet any one of the below requirements, I recommend you create a publishing company:

- You make more than $2,000 a month in book sales.

- You write in technical areas or health areas that could put you at risk of legal action.

- You want to publish other people's books.

- You're selling more than just books, such as courses, physical products, etc.

- You're an American citizen, but you live outside of the US and want a base of operations.

If you don’t meet any of these requirements, I recommend not starting your own publishing company.

6 Steps for Starting a Book Publishing Company

So you've decided this is what you want to do. Now it’s time to actually start your own business!

Here is a step-by-step guide for starting a book publishing company:

- Evaluate your business goals.

- Develop a business structure.

- Choose a name for your business.

- Choose a location.

- Make it official.

- Grow your team.

That gives you a good idea of what to expect, but let’s dive into the nitty-gritty. I’ll detail each of these 6 steps below.

Step 1: Evaluate Your Business Goals

The first step in starting your own publishing company is to evaluate your business goals. You need to figure out what your business’s point is — a business plan, of sorts.

A lot of you reading this want to publish your own books through your own publishing company. That’s great. You evaluated your business goals. But go beyond that. Write down a list of goals you can reach for.

For many of us, the goal is to provide extra legal protection and tax breaks.

For some, the goal is to encourage author collaboration or co-author ventures.

It’s smart to estimate what kind of income you plan on bringing in. This helps you plan ahead and lets you compare end-of-year income to expected income.

Ultimately, where do you see your publishing company headed in the next 5-10 years? It’s nice to have business goals set in place so you can aim for specific goals.

Step 2: Develop a Business Structure

Before you can start creating your own ebook or book company, you need to decide which type of business structure you would like to make.

There are many different types of businesses. Each has its own pros and cons.

- Corporation: A corporation is a group authorized to manage the company as a single entity. This includes stockholders, a board of directors, officers, company bylaws, etc. Establishing a corporation (S-Corp or C-Corp) requires a great deal more formalities and paperwork than the other items on this list.

- Sole proprietorship: This is a business owned and operated by a single person under their personal Social Security number rather than an EIN (Employer Identification Number). This is the simplest business form, though not the safest. The individual is personally liable in lawsuits. It’s wiser to get the liability protection of an LLC.

- Partnership: This is when multiple people (or entities) officially agree to manage/operate a business together.

- Limited Liability Company: A Limited Liability Company (LLC) protects assets like a corporation, but with the pass-through tax benefits of a partnership or sole proprietorship.

Most self-publishers end up creating a Sole Proprietorship or an LLC. Here’s a great article that discusses in more depth the difference between a Sole Proprietorship vs. LLC.

In the end, the Limited Liability Company (LLC) is the best one for most book publishers.

An LLC is more flexible in how profit distribution and ownership are organized. It combines the features of a corporation and a sole proprietorship.

A corporation is a lot more rigid in its rules of operation than an LLC.

The controlling document in an LLC is called the “operating agreement.” You may write up this agreement in a myriad of different ways to suit your needs.

For example, your operating agreement may be where you create rules for how money comes in and goes out or for “successor members” (anyone who takes over after you).

An LLC has another benefit: It allows you to tax it as a Sole Proprietorship, Partnership, or S-Corporation. Basically, an LLC is the best of all worlds and fits nicely in the self-publishing business structure.

Chances are, your favorite authors or bloggers often use an LLC to protect their brand and business.

Before you decide which is best for you, do some additional research on each.

To find out more about each type, you can check out the IRS’s resource page on business structure.

Should I set up an S corporation?

Yes, you should set up an S corporation. In other words, you should charter an LLC, then file paperwork that tells the IRS to treat your LLC as an S corporation.

- Business charter — A corporation and a Limited Liability Company (LLC) are business charters issued by state governments and may have state income tax implications.

- Tax election — Subchapter S or an S Corp tax election is paperwork you file with the IRS for the unique tax treatment of a corporation or an LLC.

A business charter and tax election are tools to protect and preserve the wealth you create from your writing. The takeaway is that the S-Corp election would be something you do after you charter your company.

Authors should elect to have their LLC treated as an S Corporation. This is part of a broader tax optimization strategy and wealth creation. Instead of your company paying income tax, the company’s net income passes on to its shareholders to claim it on their personal taxes.

Yet you are still provided with liability protection.

Step 3: Choose a Name for Your Business

It’s critical to choose a good name for your business that clearly says what you’re about, doesn’t potentially confuse your audience, and isn’t already trademarked or used in your area.

You may consider using your name or your genre, like “Chesson Publications” or “Space Pants Press.” It is a good idea to have backup names ready in case your first choice is not available.

There are 3 things to consider before choosing your business name:

- Make sure it’s not trademarked by anyone.

- Check that it’s not already used by someone in your state if you’re in the U.S.

- Do not use the words “corporation” or “inc.” unless you set up your business as a corporation.

If you’re setting up a Sole Proprietorship, you’ll likely file a DBA (doing business as), also called a “trade name registration” or “fictitious name.”

The good news is that the name availability is state-specific. This means that even though a company called “Intergalactic Press” is registered in New York, you can still use the name if it hasn’t been registered in the state you use to file.

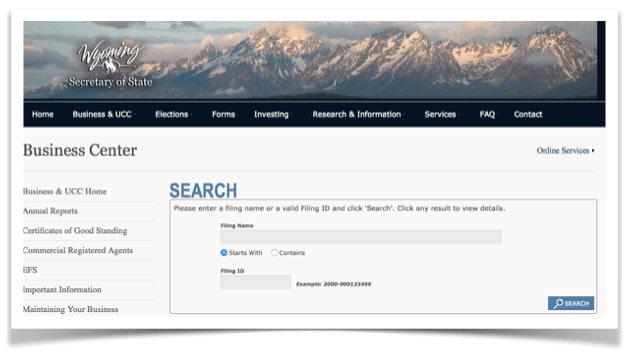

How do you check if your company name is taken? Check to see if your company name is taken by going to your respective state’s name search, by typing “Secretary of State business name search (Name of the selected state)” into Google.

The desired website is often the first result. Start hunting to see if your potential business name is available.

Step 4: Choose A Location

In setting up the business, you're going to need to choose the State you set up the company in and the actual place of business.

The State of the Business

States issue articles of organization for LLCs (articles of incorporation in the case of a corporation). The first step in location selection is the state of the organization.

For those thrifty business people looking for tax breaks or lower annual registration costs, you may have heard about incorporating in states like Wyoming and Nevada.

A word of caution: The state where you reside and do most of your work expects to be paid income tax. If you live and work in California, setting up an LLC in Nevada doesn’t get you out of California’s income tax.

In fact, doing an out-of-state charter can cost you more money as most states need you to register “foreign entities” to legally do business in the state. Some states are more lenient than others.

Remember, the primary purpose of setting up an LLC is to have the legal separation and protections that come with it. Don’t blow that by not having the appropriate registrations in the state you actually live/work in.

Place of Business

Now that you know your business state, you need a physical place of business where work actually happens.

When setting up an LLC, many self-publishers will make their personal home their place of business since they need a physical place of business. However, this may cause problems down the road.

The address of your business has to be a physical location where legal documents can be served. If you list your home as your place of business, your private information will become public.

In some states, while the owner’s name will be confidential, there must be a registered agent on the public record. You can be your own registered agent in most states, but your own name will be on public record along with your address.

Don’t list your personal home address as your place of business. Do the following instead:

- Rent a Physical Location: Renting a physical location may be nice if you actually need to go somewhere to do your work — for example, if your personal home is a distraction. I don't need to explain that renting is very costly and not a viable option for most of us.

- Get a UPS Mailbox: Most states do not allow you to put a P.O. Box number on the application. Luckily, you can get a UPS mailbox number that looks like a regular address. By choosing this option, you will need to show up in person to set up the mailbox. Once you set up your mailbox, you can have them forward your mail to your real address.

- Use A Registered Agent: Just about every state has registered agents that will act as your office for you. There is a fee associated with this, but it usually includes setting up your LLC as part of the service. This will eliminate your name as the registered agent being on the public record.

- Set up a Virtual Office: Personally, virtual offices are my favorite option. They’re professional offices that give you a specific mailing address, collect your mail, forward it to you, and can be your Registered Agent (an extra level of personal protection). Furthermore, most virtual offices will give you a 1-800 number and record and send your voicemail to you electronically. This option is excellent for those who travel or reside in a state with extraordinarily high business tax rates. You can set it up from your home in a different state or from a foreign country — such as Sri Lanka, as I did.

Step 5: Make It Official

Now that you’ve identified your business goals, business structure, business name, and business location, it’s time to make this official!

Below are 7 quick steps to making your new business official:

- Register your business.

- Obtain your Employer Identification Number (EIN).

- Set up a business bank account.

- Set up an accounting system.

- Register your domain name.

- Create a publisher's KDP account on Amazon.

- Schedule an annual business meeting and take minutes.

1. Register your business.

You have 2 main options on how to register your business:

- Do all the required registration and paperwork yourself. Each state has different requirements, so I can’t walk you through those specific steps.

- Or keep it simple and use the services like My Company Works or GovDocFiling to get your publishing company started fast and make sure it’s done right.

And just like that, you could be a President/Owner/Founder of your very own small business!

How much does it cost to start a publishing company? Costs to start a publishing company vary from state to state. Generally speaking, the lowest fees are $50, and the highest is $800. There are usually annual fees due each year. If you plan to use a registered agent, then expect additional fees for those services. Most authors see somewhere from $200-$500 a year in fees.

Some authors need to maintain extra levels of confidentiality — perhaps because of the genre they write in or their personal preference.

Certain states like Wyoming keep member information confidential. Only the registered agent is public, so you could set up a company there and use a registered agent.

In some cases, you may need to create two LLCs to form a legal barrier between you and the public. This doubles the cost of starting a business, but it might be necessary to give you the confidentiality you desire.

Now that you've become an official business in the eyes of the government, it's time to take specific actions to ensure you're a legitimate business. You need to do certain things to get the most out of your publishing company and ensure its legitimacy.

2. Obtain your EIN.

An Employee Identification Number (EIN) is used to identify a business entity. Also known as a Federal Tax Identification Number, an EIN is a 9-digit number that the IRS uses during tax season.

Upon registering your business, you'll get an EIN — like a Social Security number for businesses. When you have an EIN, ensure the documentation for any accounts that you've set up are associated with this number.

3. Set up a business bank account.

To keep your personal income and the business’s financials separate, you need to have a business bank account. Separation of personal funds from business funds is essential.

You may set up an account with a traditional brick and mortar bank or an alternative online banking service like PayPal.

4. Set up an accounting system.

Whether you hired a professional accountant or are keeping detailed Google Sheets, you have to keep track of your financials from the very beginning. And it has to be perfect. All those I’s dotted and those T’s crossed.

Two popular options for accounting software include Quickbooks and Wave Financial.

5. Register your domain name.

People need to be able to Google your business. You don’t want those leads to go to waste. That’s the main reason you need to register your domain name — a URL.

A professional author website is the best way to tell people about your business and your books.

Official social media accounts also help like Instagram, LinkedIn, Facebook, etc.

6. Create a publisher's KDP account on Amazon.

If you've published books before on your own personal account and you want them to be in the business' account, then you need to do one of two things:

- Change your personal account to the business' by changing the necessary information in your settings to reflect the company (address, EIN, etc.).

- Make a new KDP account and move your books to it.

As per Amazon's TOS, a person is not allowed to have 2 accounts. But don't worry. You have an account, and your business has an account. Those are 2 accounts you control, which is still in compliance with Amazon’s TOS.

7. Schedule an annual business meeting and take minutes.

If you're an LLC or Corporation, you must have at least 1 annual business meeting a year and ensure you document it and place it as your minutes.

Without this, your legitimacy as a company wanes.

For example, my wife and I will schedule a dinner once a year on the company's dime, have a business meeting, and take detailed minutes.

8. Publish a book.

This is the whole reason for a publishing company! Imagine how sweet it will be when you publish that first book.

Whether it’s a children’s book, a biography, a mystery, a short story, an ebook only, or print-on-demand, you’re now a part of the publishing industry.

You need to purchase an ISBN (International Standard Book Number) for each work to sell books. An ISBN is an internationally-recognized 13-digit number that is supposed to simplify sales and distribution. Bowker is the official ISBN agency for the US and Australia.

Step 6: Grow Your Team

You're now a full-fledged publishing company! With your business made official, it's time to grow your team. (If you intend to be the sole employee of the company or the only author represented by the company, then you’ve already finished the last step.)

Who do you need on your team? Here are some possibilities for expanding your publishing company beyond just yourself:

- A dedicated accountant

- Other authors you can now publish

- Freelancers for cover art, formatting, editing, web design, etc.

- Marketing or social media specialists to maintain your online presence

Look for authors whose works you’re interested in publishing. You can even split royalty through your new, legitimate publishing house.

If your newly minted publishing company manages co-authored projects, you'll have an extra challenge ahead of you.

Calculating royalties and dividends owed can be a hassle — especially if those need to be split up in any way. However, the good folks over at Draft2Digital have created a solution for that exact situation.

While PublishDrive led this charge with PublishDrive Abacus, Draft2Digital is our choice for book distributors, and they also have this revolutionary program in the publishing world. You can read their announcement here.

This program allows the authors to:

- Calculate royalties between co-authors

- Provide each contributor with detailed reports

- And streamline the entire accounting process

This program is geared entirely towards publishing groups that publish on Amazon and Kindle Unlimited.

In order to be part of the royalty split program, your books do have to be enrolled on Draft2Digital, even for platforms like Amazon. But the headache it saves you could easily be worth the cost of the commission D2D takes.

See also our review of Draft2Digital.

Setting up a Publishing Company with MyCompanyWorks

If going through all the steps above to form your publishing company sounds like a lot of work, you can significantly simplify the process (for an added fee, of course) with a company like MyCompanyWorks, which is a business that helps you set up your own business.

While MyCompanyWorks doesn't take all the work out of the process (you'll still have to do things like visit your bank to set up a business bank account), it does make the process a lot easier.

Here is a brief walkthrough to get started:

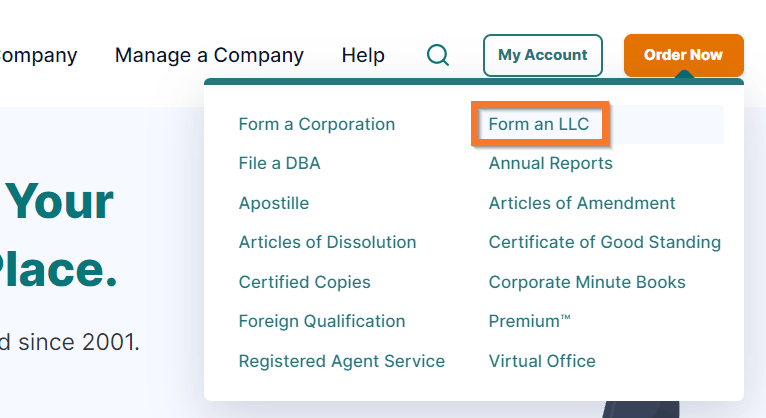

From the homepage, you can hover over Order Now then select Form an LLC.

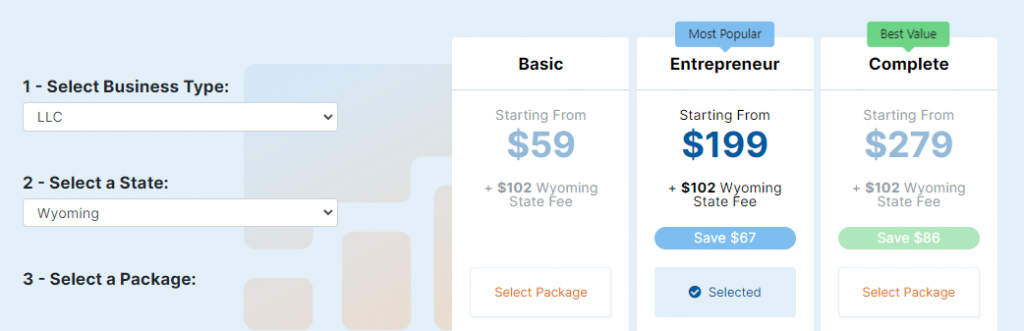

Then you select the state the you want to register under, as well as the desired package.

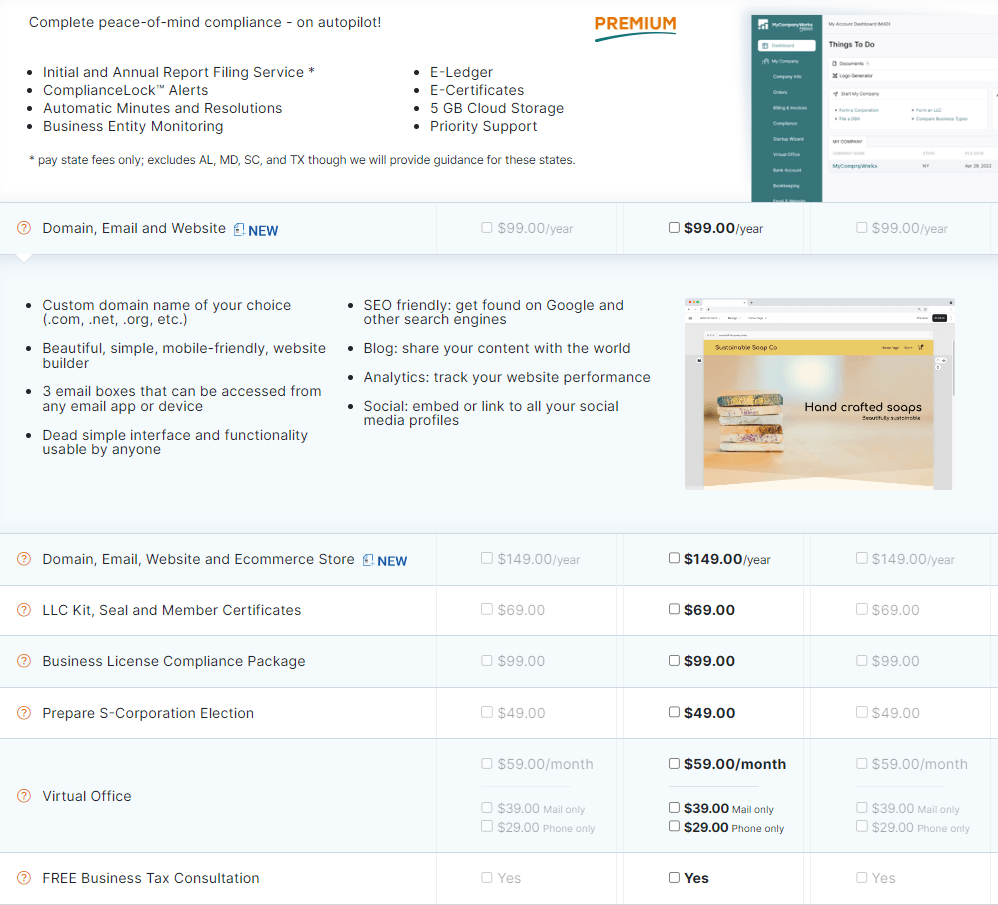

MyCompanyWorks also has a lot of additional services, some of which are useful (like “Prepare S-Corporation Election”).

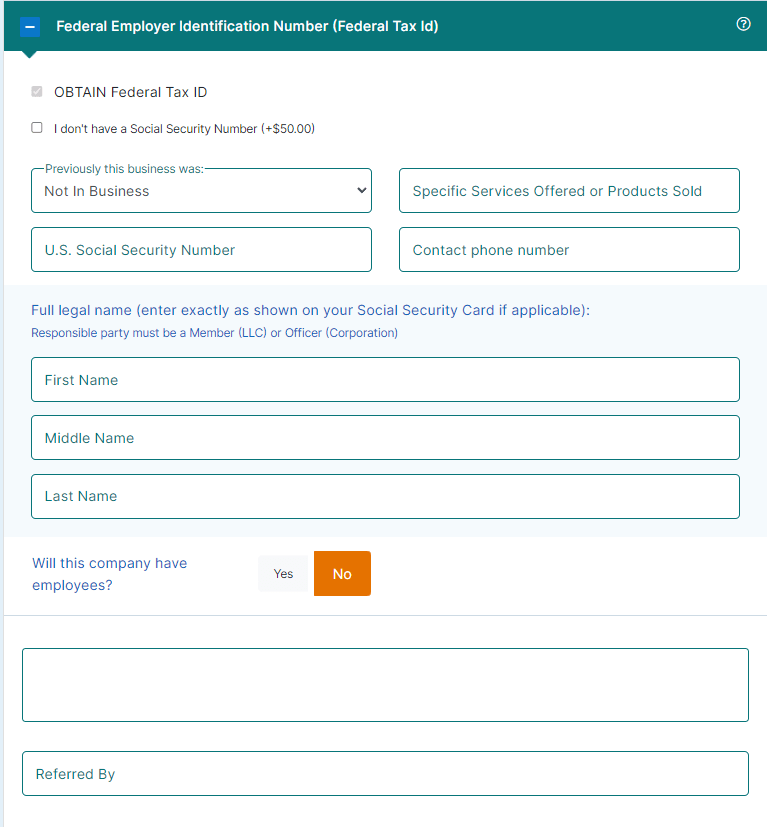

Next, you begin inputting your information. I won't screenshot everything here (because it's a lot), but it includes your contact info, your name for the LLC, the list of people that manage the company, and the information needed to get your Federal Employer Identification Number.

MyCompanyWorks walks you through the entire process easily, and before you know it, you'll have a business ready to go!

Resources For Setting Up a Publishing Company

Check out these fantastic resources for setting up your own publishing company. I personally use or have used most of these.

Setting up an LLC, Corporation, or Sole Proprietorship can feel daunting. If you're like me, then you probably conduct plenty of research before carrying out such a monumental task.

Before I jumped into setting up my LLCs, I did a bunch of research.

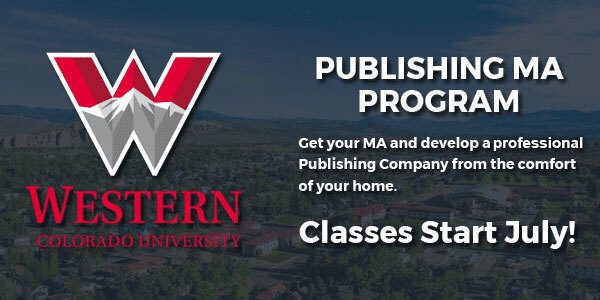

WCU’s Publishing MA Program

Get a Master’s degree in Publishing with this Publishing MA program.

If you're looking to create a legitimate company publishing many books and want to take yours to the next level, then perhaps a formal education in publishing is right for you.

Western Colorado University offers a full-fledged Publishing MA program, one of the only such programs to embrace indie publishing.

It is a 1-year program (from July to July) and only requires you to spend two weeks in the gorgeous Colorado mountains while the rest of the course is taught online.

It is equally balanced between traditional publishing and indie.

Students will engage in innovative projects, such as:

- Developing the concept for an anthology (which pays pro rates)

- Soliciting submissions

- Reading the slush pile and choosing the stories

- Issuing contracts

- Editing pieces

- Designing and producing a book and its cover

- Publishing that book

- Making a marketing plan

As the final project, students will select a public-domain classic, acquire the text, and work through every stage of producing and releasing the book via a mid-sized publisher (WordFire Press), which will list their name on the copyright page.

The program is run by the award-winning and legendary science fiction author, Kevin J. Anderson, who personally teaches all the courses. Kevin has 56 national or international bestsellers and 23 million copies in print in 30 languages.

His publishing company, WordFire Press, has released nearly 350 titles from 95 authors in ebook, trade paperback, hardcover, and audio. He is a highly qualified publishing professor.

If you are interested in taking this program, you need to act fast. The program fills up quickly every year, so don't delay!

More Info on Starting a Publishing Company

Need more info? Here are a few articles I found useful when I was doing my original research on starting my own publishing company:

- List of Resources for Setting Up a Publishing Company: This quick guide is great for the terminology and list of resources in each of the steps.

- How to Form an LLC by WSJ: Who better to give you more information than the Wall Street Journal in setting up your own company?

- 6 Mistakes to Avoid When Setting Up Your Corporation or LLC: What more can I say from that title than make sure you don't make any of these mistakes.

- Pat Flynn's Personal Details on Setting Up His LLC: Pat Flynn of SmartPassiveIncome.com does an excellent job explaining why and how he did his LLC setup.

- Nuts and Bolts: Nitty-Gritty Details, Incorporating, and Taxes: This one is my favorite.

And don’t forget to check out my podcast where I spoke with my lawyer about publishing business structure.

Are you ready to start a publishing company?

With a few hundred dollars and some spare time, you are ready to start your own publishing company and establish legitimacy, legal liability protection, and valuable tax breaks.

Thanks to services on the Internet, it is easier than ever to set up your own book publishing LLC or Corporation.

Although annual costs persist each year, the benefits of starting your very own publishing company will quickly outweigh this.

Better taxes, increased personal security, and more publishing capabilities were the main reasons I started 3 different LLCs to support my entrepreneurial habits.

Now that you know how to start your very own publishing company, get started and become a book publisher today!

If you have any questions along the way, don’t hesitate to ask me. Leave a comment below to tell me what you found most helpful.

But do remember that I am not a lawyer — just an experienced entrepreneur.

Cheers,

Hi Dave, I tried to send you a PM at your Contact Me page, but I can’t get the message through. It says this all the time: There was an error trying to send your message. Please try again later. Can I perhaps place my message it here? Please advice. Thanks!

This is awesome information right here for starting up your publishing company. I’d definitely say e-book publishing has made a huge impact in my income and financial status. If anyone is looking to make this move definitely read this article over and over again. Dave covered all the bases here this is freaking awesome.

If you want to learn a little more about the publishing process here is this video that basically teaches you how to publish your book to Amazon for FREE. https://www.youtube.com/watch?v=S5KwmDz4oos

Also, can you tell me from your experience about profits. I have incorporated a publishing company but I am not looking to take a percentage of people royalties. As I read in one of the post located here it would be a little hard to split the profit showing tax wise, so I want to charge a one-time upfront fee; where that person pays for all of there own edits, book cover design, and anything else that they need. I only want to publish the book and they can tell me who they want to use for a print on demand. This keeps the work on the individual who is looking to put in the work but doesn’t want a publishing company and they still can hold the rights to their book. Can I do this or not? What are the pros and cons?

Thanks,

Hi Dave,

My question is, how do you publish other people books under your publishing company without you being sued? What I mean by that is; when you publish someone book you don’t know if they have used other people information or cited correctly. You don’t know if they copied someone else writing material or not. With that being said as the publishing company do you handle that with a contract saying something like you are not aware of any copyright infringement of the person who has presented the book for publishing or is there another approach that you have to protect your publishing company when it comes to publishing someone else book?

I just wanted to say thank you very much! I love the work you put into this and thank you for sharing it! I feel I can trust it and I look forward to the reading list you gave….thanks again! 🙂

Glad to help.

Hi Dave could you expound on how to not just publish for yourself but to publish a book for someone else using Amazon and how you would go about that. I was going to create a publishing name for just my books then I thought why not do this for others and get paid. I would basically charge them a fee for me to do all the self publishing for them on Amazon and then however Amazon does that with the royalties that’s all theirs. Am I thinking in the right direction or would this be done differently, also would my self publishing company name go on their books?

The way to do this is to publish their book under your KDP account. Then you’ll be responsible to figure out how much you owe them and pay them. They won’t have any clue as to how well the book is doing unless you give them access to your KDP account (which I recommend not doing). You can’t tell Amazon to pay them…they will only pay you and then you’ll need to pay the author.

Hi Dave, can’t she simply become an Amazon affiliate? That way she can sell any book already on Amazon.

That’s not what she’s asking. She’s talking about becoming a publisher and how can she load their books as a publisher. But I get what you mean…it sounds like she’s straddling the two.

Hi there 🙂 I am looking to help a talented friend self-publish her cookbook. She’s a technophobe and needs my help. I have only published one book to KDP. I gather from this thread that I can publish her book to my bookshelf on Amazon without altering her name, and get the royalties over to her. I don’t need to create my own company and Federal tax ID to do this? Thank you!

Hi Jen, unless you’re taking a cut, it would definitely be best to publish it in her KDP. If you are taking a cut, and she’s selling a significant amount, you really should consider a LLC for such an operation.